A 2532017 that are effective as from year of assessment 2015 were published in Malaysias federal gazette to provide incentives to qualifying companies that are incorporated and resident in Malaysia and that have incurred qualifying capital expenditure relating to automation equipment used in Malaysia solely for the purpose of carrying on a qualifying project ie. Guidelines on MSC Malaysia Financial Incentives Grandfathering and Transition under Services Incentive The Guidelines explain the.

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

Applications received by 31 December 2022.

. Meanwhile for the taxpayer the annual energy saving conveyed by the green envelope components is able to compensate the amount of tax increment. Consumer Protection in Islam. The salient features of these incentives are discussed below.

Major highlights for 2017 Malaysia Budget Marginal reduction of the corporate income tax rate on the annual incremental chargeable income for YAs 2017 and 2018 Reduction of corporate. MALAYSIA offers a variety of incentives including incentives that are granted through income relief or as allowances. RM200000 to RM300000 per year of.

Yayasan Wakaf Malaysia YWM and Perbadanan Wakaf Selangor. Of RM500000 to RM700000 per year of assessment whilst the limit of deduction. For sponsoring foreign arts cultural and heritage activities be increased from.

The case study was conducted using review of documentation including annual waqf report and digital information on waqf practices and interviews with respondents from two waqf agencies ie. Major highlights for 2017 Malaysia Budget Marginal reduction of the corporate income tax rate on the annual incremental chargeable income for YAs 2017 and 2018 Reduction of corporate. Experience any changes on their existing tax.

Tax incentives can be defined as all measures that provide for a more favorable tax treatment of certain activities or sectors compared to what is granted to the general industry Klemm 2009. 10 tax rate for up to 10 years for existing companies in Malaysia which undertake services activities for a new business segment in Malaysia. The Government has been progressively introducing tax rebates and reliefs to promote the capital market.

The ECER is one of three economic corridors in with the aim to accelerate economic growth in the country. Waqf Agencies and Tax Incentives in Malaysia Amalina Abdullah Saleh Hashim Siti Alawiyah Siraj Mohd Daud Awang. Rebate for Zakat Fitrah or other Islamic religious dues paid.

Malaysia has extended the timeline for applicants seeking income tax incentives for qualifying activities in the East Coast Economic Region to December 31 2022. There are specific criteria and rules for dealing with tax incentives. 400 each If husband and wife are jointly assessed and the joint chargeable income does not exceed MYR 35000.

For example if incentives are granted through allowances unused allowances can be carried forward indefinitely to use for future statutory income with the exception of certain. 16 Oct 2021. However through a reduction model the local authority does experience around RM 18 to RM 40 minimum tax increment on their existing tax revenue.

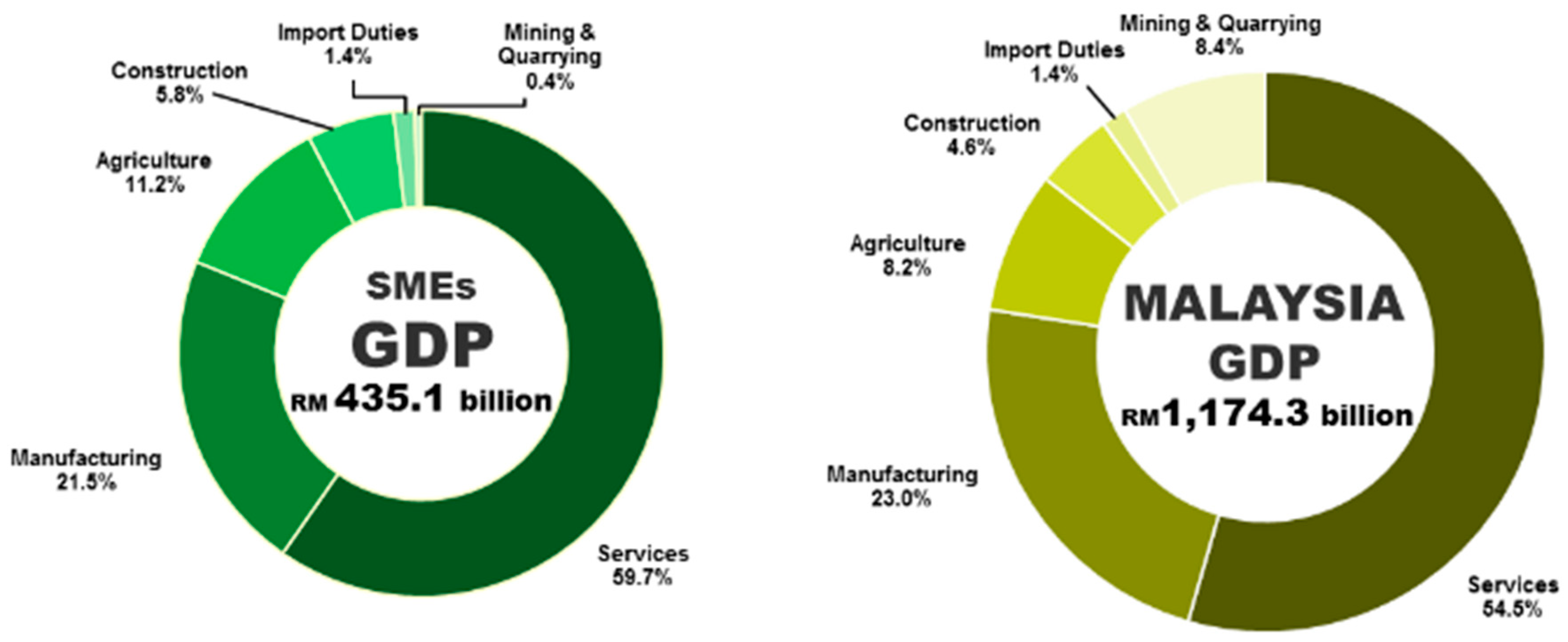

Well as foreign arts cultural and heritage activities be increased from an aggregate. It is proposed that with effect from the year of assessment YA 2017 the corporate income tax rate for the chargeable income up to RM 500000 will be reduced by 1 from 19 to 18 to ensure that SMEs remain competitive. Malaysia are taxed at 19 on chargeable income up to RM 500000 with the remaining chargeable income taxed at 24.

Pioneer Status PS The standard PS incentive is a partial exemption from the payment of income tax for a period of 5 years up to 70. Therefore this paper highlights the role of tax incentives in promoting the sustainability of waqf agencies in Malaysia. 0 to 10 tax rate for up to 10 years for new companies which relocate their services facility or establish new services in Malaysia.

Some of the major tax incentives available in Malaysia are the Pioneer Status PS Investment Tax Allowance ITA and Reinvestment Allowance RA. Grandfathering timeline applicable to existing MSC Malaysia Status companies with income. Tax incentives are very important for the voluntary sector especially in supporting their financial needs to provide services for a long period of time.

The incentives include up to 100 percent income tax exemption for a wide range. If husband and wife are separately assessed and the chargeable income of each does not exceed MYR 35000. There are two incentive models developed in this paper namely the property tax assessment exemption model and the reduction model.

Individual and corporation will enjoy a tax incentive for investing or issuing bond For more information on tax incentive for bond. Guidelines on MSC Malaysia Financial Incentives Services Incentive Income Tax Exemption Both Guidelines are effective 1 January 2019.

Budget 2022 Here Are The Key Highlights And Takeaways For You

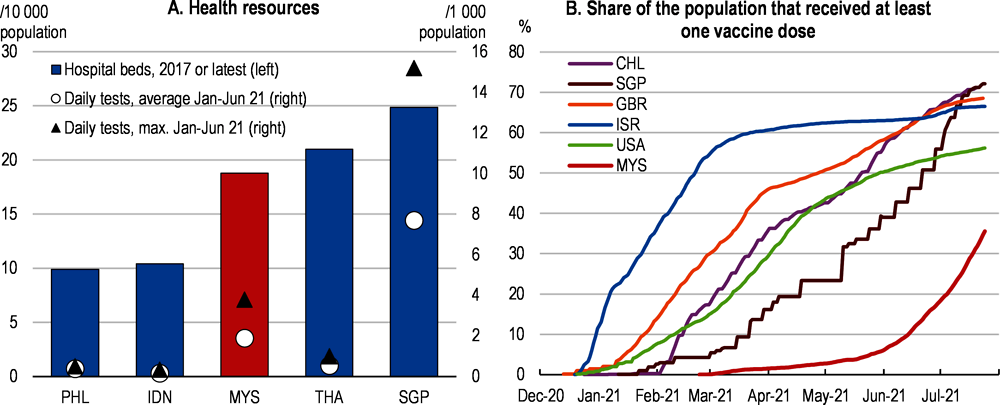

1 Key Policy Insights Oecd Economic Surveys Malaysia 2021 Oecd Ilibrary

Sustainability Free Full Text Role Of Social And Technological Challenges In Achieving A Sustainable Competitive Advantage And Sustainable Business Performance Html

Labuan Offshore Company In Malaysia

1 Key Policy Insights Oecd Economic Surveys Malaysia 2021 Oecd Ilibrary

Pdf Political Connections Corporate Governance And Tax Aggressiveness In Malaysia

1 Key Policy Insights Oecd Economic Surveys Malaysia 2021 Oecd Ilibrary

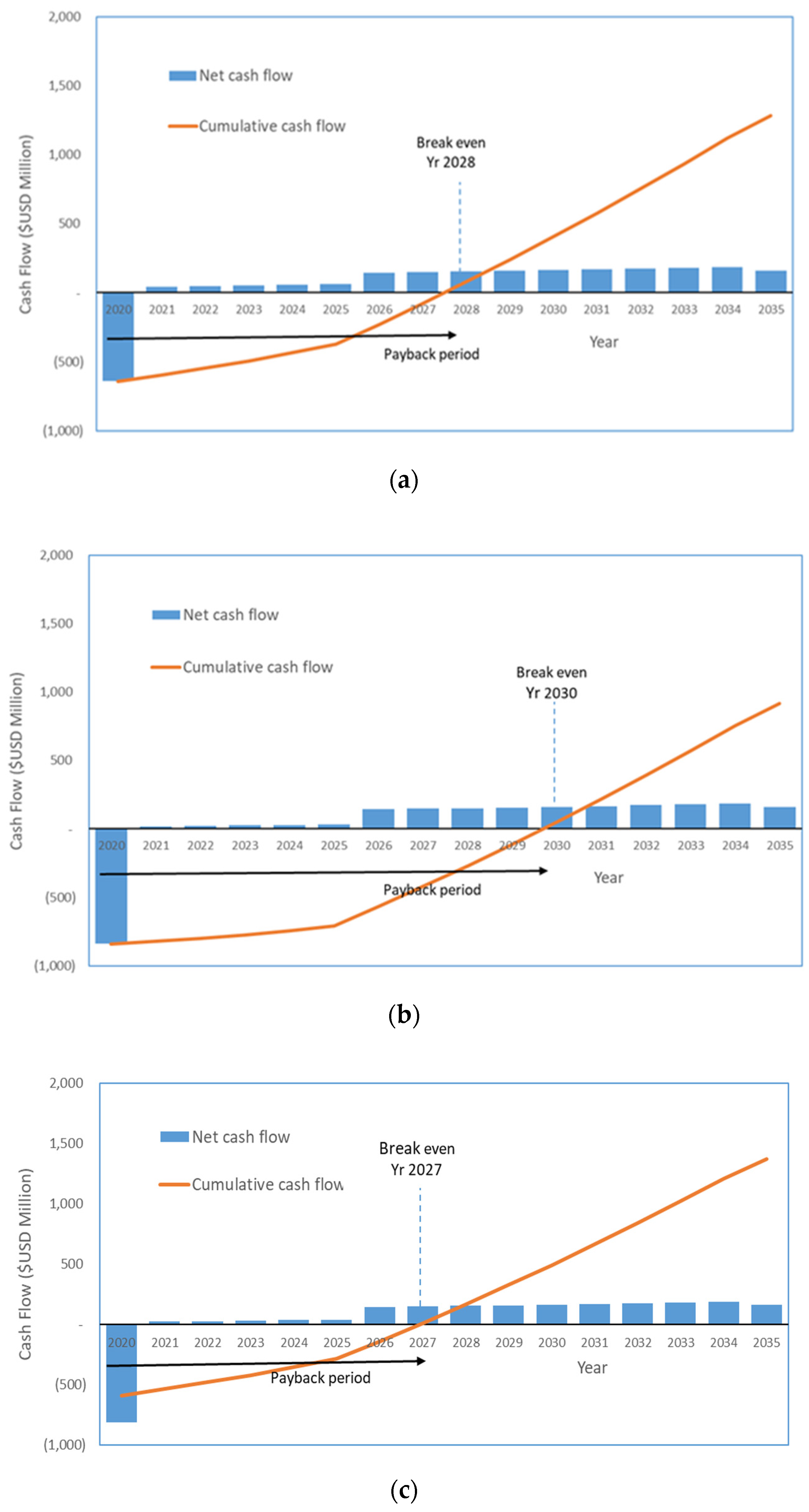

Processes Free Full Text Techno Economic Analysis Of Co2 Capture Technologies In Offshore Natural Gas Field Implications To Carbon Capture And Storage In Malaysia Html

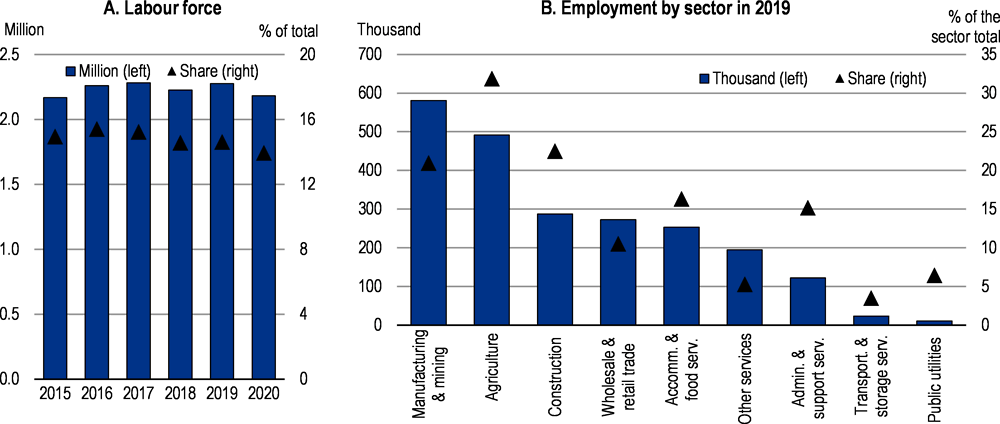

3 The Business Environment For Smes And Entrepreneurship In Viet Nam Sme And Entrepreneurship Policy In Viet Nam Oecd Ilibrary

Malaysia S Mof Has No Power To Restrict Investment Allowance Claim International Tax Review

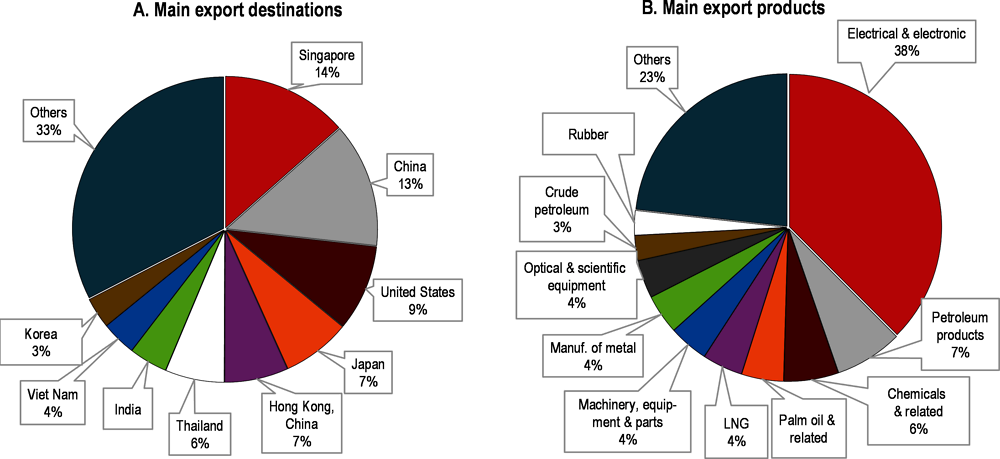

1 Key Policy Insights Oecd Economic Surveys Malaysia 2021 Oecd Ilibrary

Guide On Tax Incentives In Malaysia

Incentives Msc Status And Tax Exemption Gbs Iskandar

Kazakhstan Toward Fiscal Sustainability And Economic Transformation

Measuring Tax Support For R D And Innovation Oecd

Pdf The Malaysia Us Relations The Presence Of The Us Mncs